‘Fair tax’ paves the way to taxing retirement income in Illinois

By granting broad new taxing authority to Springfield, the progressive income tax amendment makes a retirement income tax much more likely – a fact some supporters have acknowledged publicly.

The “fair tax” is being sold as a tax on the wealthy, but if voters on Nov. 3 remove the Illinois constitution’s flat tax protection they will be granting state lawmakers broad new taxing power that would make it easier to go after seniors and their retirement income.

Illinois lawmakers in 2019 approved a defining feature of Gov. J.B. Pritzker’s policy agenda by agreeing to ask voters to amend the Illinois Constitution and remove its flat tax protection. They also set introductory rates that start hiking taxes on residents making over $250,000.

Among several other negative policy outcomes, the adoption of a progressive income tax would make it significantly more likely that Illinois will adopt a retirement income tax in the future. That’s because removing the flat income tax protection also removes a key political barrier to imposing a tax on retirement income.

Lawmakers have the ability to withdraw the amendment in the wake of COVID-19 and the economic slowdown. If they fail to act and voters are convinced to pass the progressive tax, then it will start taking billions more from Illinois’ economy just as the state struggles to recover from the pandemic.

‘Fair tax’ supporters push for a retirement income tax

Illinois elected officials and advocacy groups have proposed taxing retirement income in the past. Former Chicago Mayor Rahm Emanuel proposed taxing all retirement income above $100,000 per year in 2019. The Civic Committee of the Commercial Club of Chicago that year proposed exempting only $15,000 of retirement income per year.

In fact, proponents of the progressive tax have linked the issues together, acknowledging that one tax hike makes the other more likely.

The Chicago Sun-Times’ editorial board wrote, “Pritzker’s progressive income tax plan can set the stage for far greater tax fairness. Next, that tax should be expanded to include the highest retirement incomes.”

Daniel Biss, a former Illinois state senator, Democratic candidate for governor and progressive tax advocate, said: “I would only consider taxing retirement income once we’ve amended the Illinois Constitution to allow for a progressive income tax …”

Public opposition has historically killed proposals to tax retirement income in the Prairie State. A 2019 poll from the Paul Simon Public Policy Institute found 73% of Illinoisans somewhat or strongly opposed eliminating the retirement exemption, while only 23% somewhat or strongly supported the change.

But under a progressive income tax structure, for the first time Illinois lawmakers would have the ability to raise taxes on certain segments of the population based on income.

The power to tax different income groups differently makes it inherently easier to raise taxes, because lawmakers do not have to worry about facing backlash from all taxpayers at once. Progressive tax powers would enable Springfield to begin taxing retirement income above only a certain level but then gradually lower the exemption threshold to raise additional revenue, slowly adding more Social Security and pension income to the tax base.

Additionally, Pritzker’s amendment would allow for lawmakers to tax retirement income at a different rate than regular income, making the tax easier to impose initially. Under current law, any retirement income would have to be taxed at the flat rate of 4.95%. Under the “fair tax,” lawmakers could begin with a 1% rate on retirement income to avoid voter backlash and raise the rate gradually in an effort to raise revenue.

Illinois is currently one of just three states with an income tax that exempts all retirement income from taxation. Nine states do not collect taxes on general income from salaries and wages.

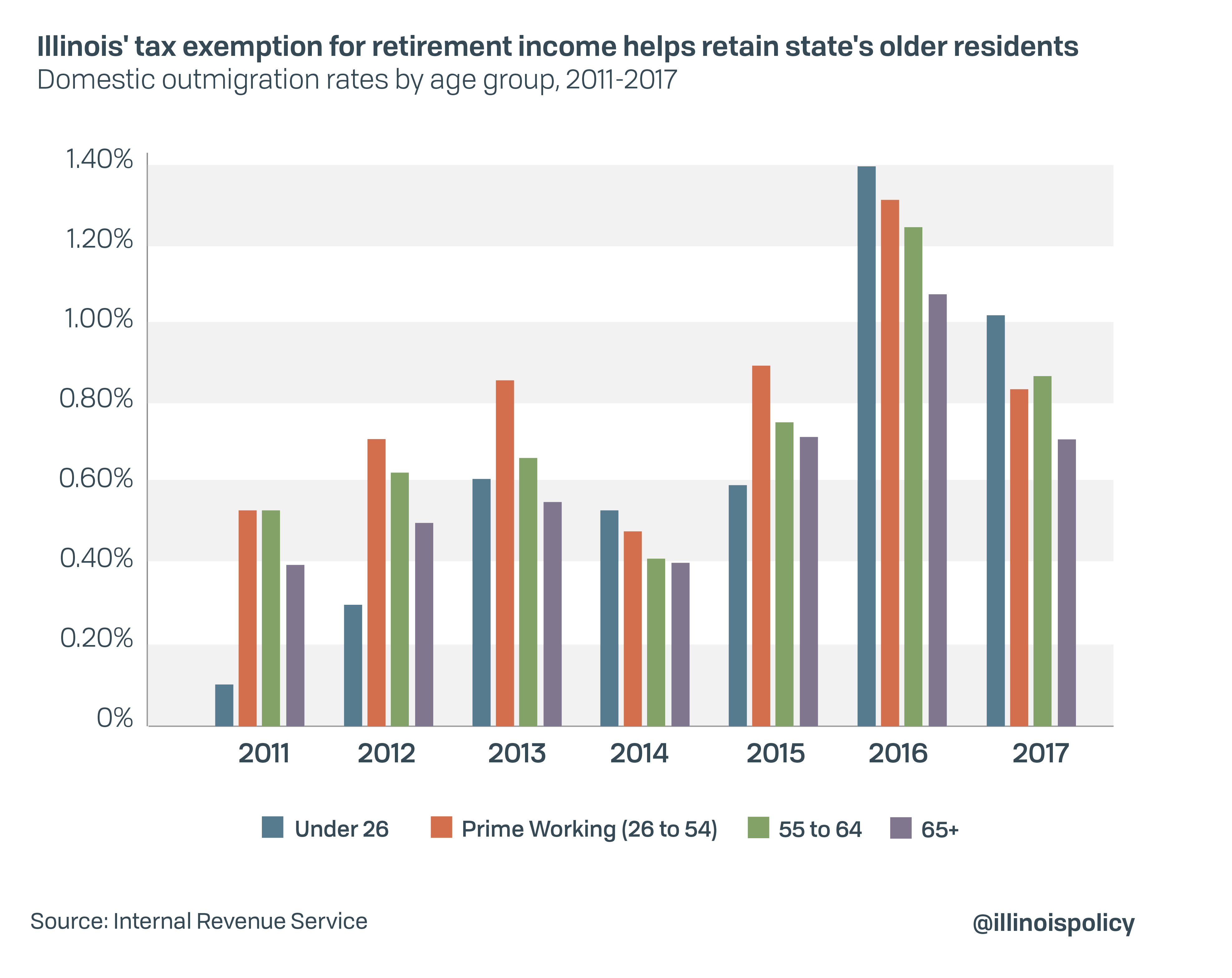

The lack of a retirement income tax is one of the few competitive advantages of Illinois’ tax code in an otherwise high-tax state. It helps minimize outmigration among retired residents. In fact, since the 2011 income tax hike, Illinois has been able to retain residents above the age of 65 better than every other age group.

The over-65 outmigration rate has been the lowest among all age groups on average during the time period and in each year since 2013.

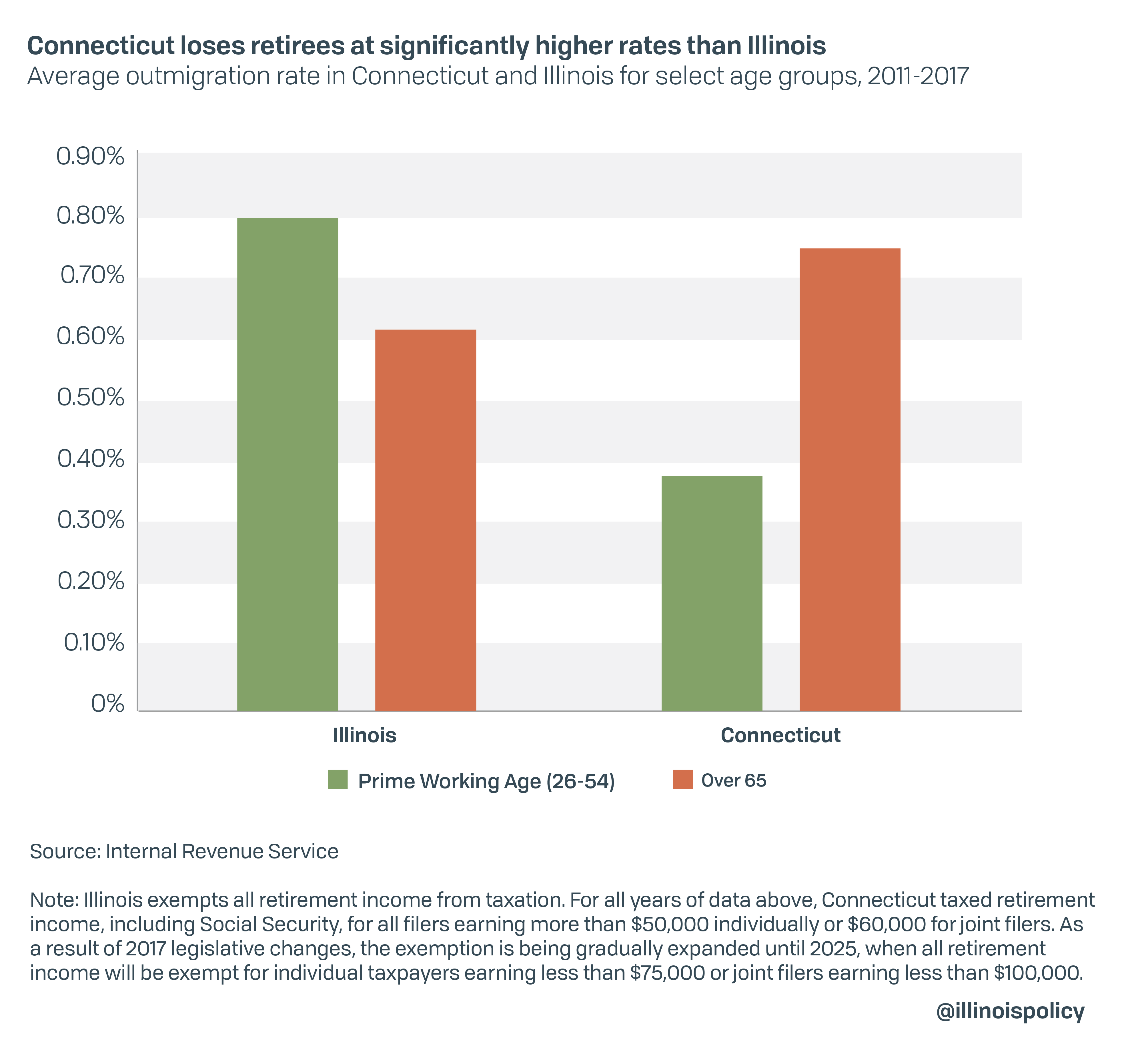

The only state to shift to a progressive income tax structure in the past 30 years, Connecticut, tells a different story.

Connecticut for the past decade has taxed retirement income, including Social Security, above $50,000 for single filers and $60,000 for joint filers – the above-65 outmigration rate has been more than double the outmigration rate for prime working age adults, or people ages 26 to 54.

Comparing rates between age groups and within states helps control for factors that affect migration besides retirement tax policy. While both states are losing residents among all age groups, the gap between retirees and prime working age adults may suggest residents view Illinois as the better state for retirement.

Illinois has lost population for six years running, driven primarily by adults in their prime working years leaving for other states. The most common reason residents give for wanting to leave is the high tax burden, according to public opinion polling conducted for NPR and the University of Illinois-Springfield. While people older than 65 have left as well, they’ve done so at a lower rate, which is likely influenced by the retirement tax exemption.

“The elderly out-migrate significantly less if a meaningful pension exemption is offered by the state,” according to a large statistical study published in the Journal of Regional Analysis and Policy. This matches the more general finding in economics literature that Americans tend to move from high tax states to lower tax states.

Connecticut – the last state to adopt a progressive income tax in 1996 – has already provided Illinoisans with plenty of evidence showing the progressive income tax would be bad for the state. Proponents there made very similar claims to those being used to push a progressive tax in Illinois, including middle-class tax relief, balanced budgets and no economic damage. But all of those promises were broken. Instead, Connecticut’s change to a progressive tax was followed by a 13% jump in middle-class income taxes, a 35% increase in property taxes, a sharp increase in poverty and continued budget deficits.

Illinois residents need to know that passing the progressive income tax amendment would fail to deliver the benefits its proponents claim, as well as make it more likely Springfield will tax retirement income in the future. With Illinois’ economic growth already being held back by persistent population loss, the state can hardly afford to drive away even more residents as it works to recover from a pandemic.