Blame Illinois exodus on jobs, housing, tax policy

Census data shows who is fleeing Illinoisans and why. Here’s why you should care.

Illinois lost more than 850,000 residents to other states during the past decade, causing the state’s population to shrink for six consecutive years and suffer the largest raw decline of any state in the 2010s.

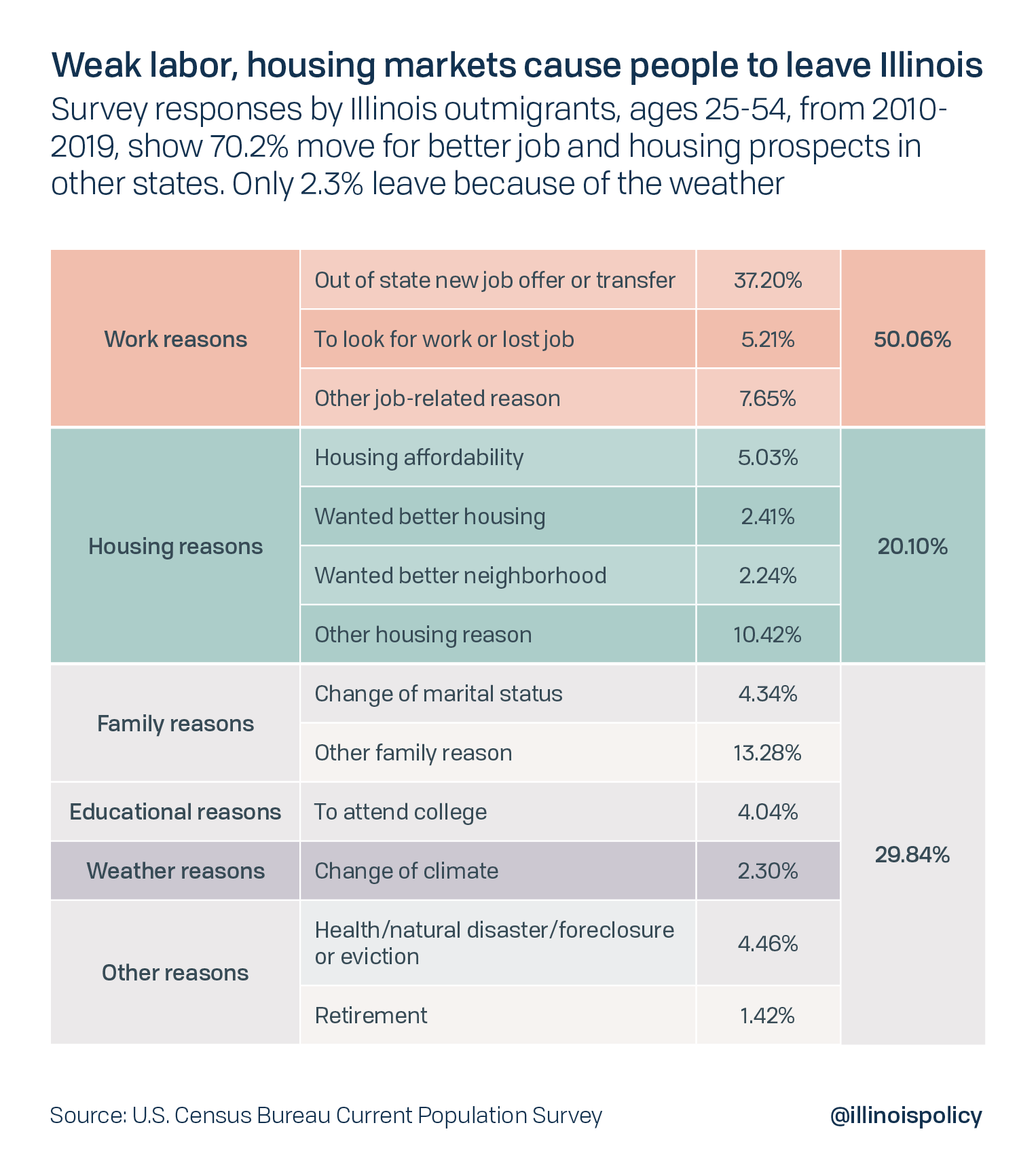

Though many assume Illinois’ cold, wet winters and hot, humid summers are to blame, people are likelier to leave the state for better job or housing opportunities. The largest group leaving were prime working-age residents, which erodes the state’s future.

Being one of only four states seeing population losses during the past decade is a big problem. It makes Illinois poorer and less diverse. It also exposes the deeper problems of jobs and housing.

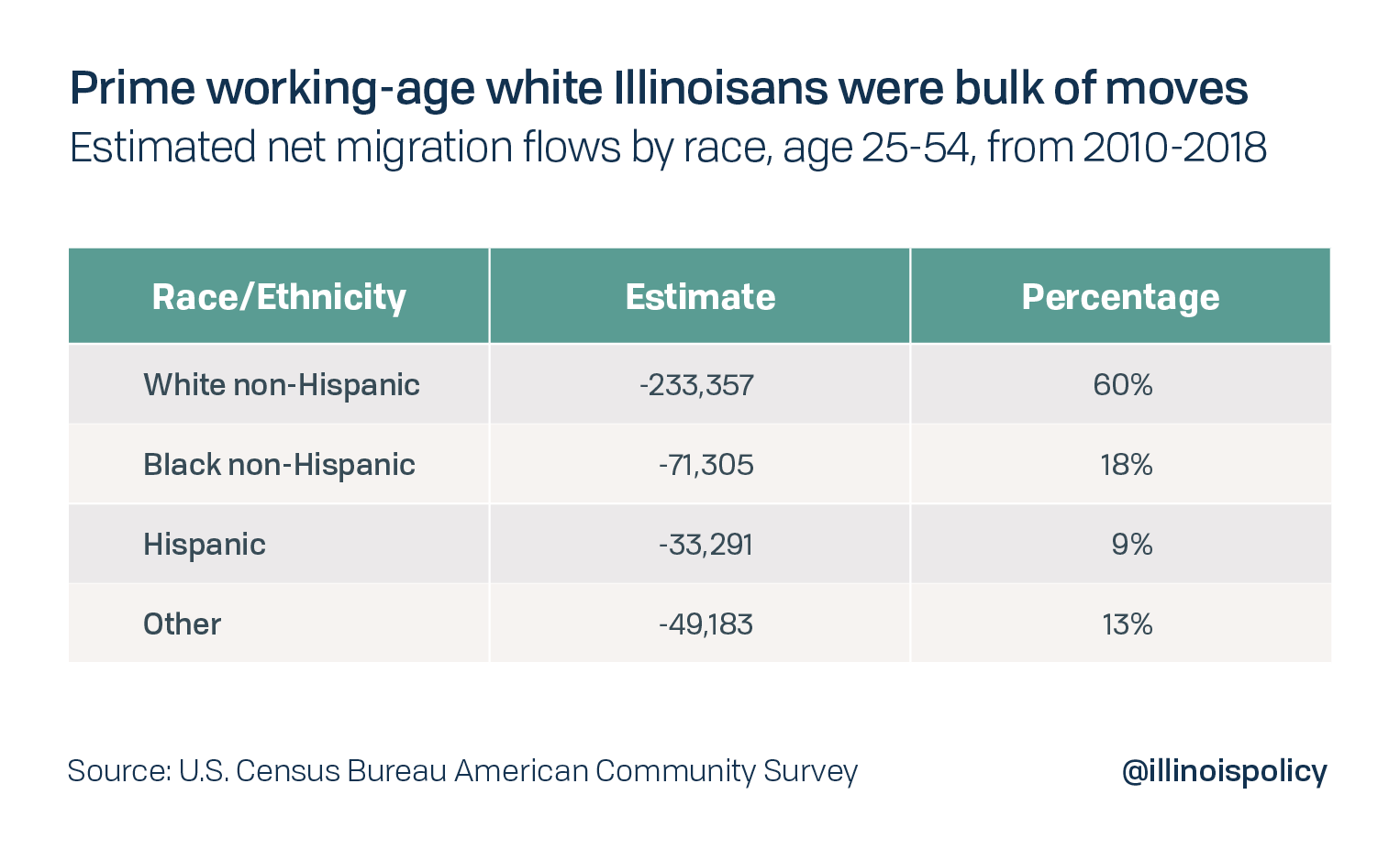

Since 2010 Illinois has lost prime working-age individuals of every race and ethnicity to other states on net, with Asian, Black, Native American and Pacific Islander Illinoisans leaving at the fastest rates. Domestic outmigration has even been enough to cause Illinois’ white and Black populations to decline.

According to U.S. Census Bureau data released June 25, the white population shrank by 5.3%, or 438,986 people, and the Black population declined by 1.7%, or 32,143, since 2010. Domestic outmigration has been the primary driver of this decline, and while black Illinoisans have been more likely to leave the state than white Illinoisans, the sheer size of the white population coupled with lower birth rates have resulted in a larger population decline than in the Black community.

Despite net domestic outmigration, higher birth rates and international migration have resulted in growth for Illinois’ Asian and Hispanic populations since 2010. Asian populations increased by 23.6%, or 155,535 people. Hispanic populations grew by 9.4%, or 194,671 people.

But if you judge by Illinois’ chief executive officer, losing people is no big deal.

“People talk about the exodus from Illinois, and they’ve blamed it on a lot of things, because we’ve lost population,” Gov. J.B. Pritzker said. “Illinois lost population in 94 out of the last 95 years, so it’s not like it’s a new thing that we have a slight out-trickle of people leaving the state. Nevertheless, I’d like to reverse it.”

Illinois’ outmigration is hardly a “slight out-trickle.” Illinois’ exodus has gotten worse over time. Making matters more disturbing is the most recent data ends in 2019, so Illinois’ people problems were driven by poor labor and housing markets well before the COVID-19 crisis erased 737,700 jobs and threatened to double mortgage delinquency in the state.

Nevertheless, here’s why losing population matters.

While employment and housing reasons also top the list of why migrants move to Illinois, far more Illinoisans are leaving the state, resulting in net outmigration. These responses by former Illinois residents suggest reversing the state’s outmigration crisis begins with improving job prospects and making buying a home in Illinois a worthwhile proposition.

The responses of those who left also closely align with the reasons those who remain in the state give for wanting to leave. Taxes were the No. 1 reason Illinoisans said they wanted to leave, according to a poll conducted late last year by NPR Illinois and the University of Illinois Springfield. While taxes weren’t an option to report in the Census Bureau’s survey, taxes greatly affect the labor and housing markets that were cited as the top reasons for leaving.

The housing and labor markets are closely linked and are both affected by tax policy. Recent income tax hikes have already fostered an environment in Illinois that makes it harder for Illinoisans to find work and reduces wage growth prospects for those who are employed. Meanwhile, rising income and property taxes have made housing less affordable in Illinois and reduced returns on housing investment relative to other states.

Which Illinoisans are leaving?

Illinoisans from virtually all walks of life have contributed to the exodus. Every income and age group reported by the IRS migration data is experiencing net negative migration, with the prime working-age and middle-income earners making up the bulk of the exodus. Meanwhile, the wealthy are fleeing at the fastest rates.

While the IRS provides robust data on who is leaving by age and income level, Census data can be used to discern other characteristics about those who leave.

While white Illinoisans make up 60% of prime working-age outmigrants, this is simply because there are more whites in Illinois than any other group.

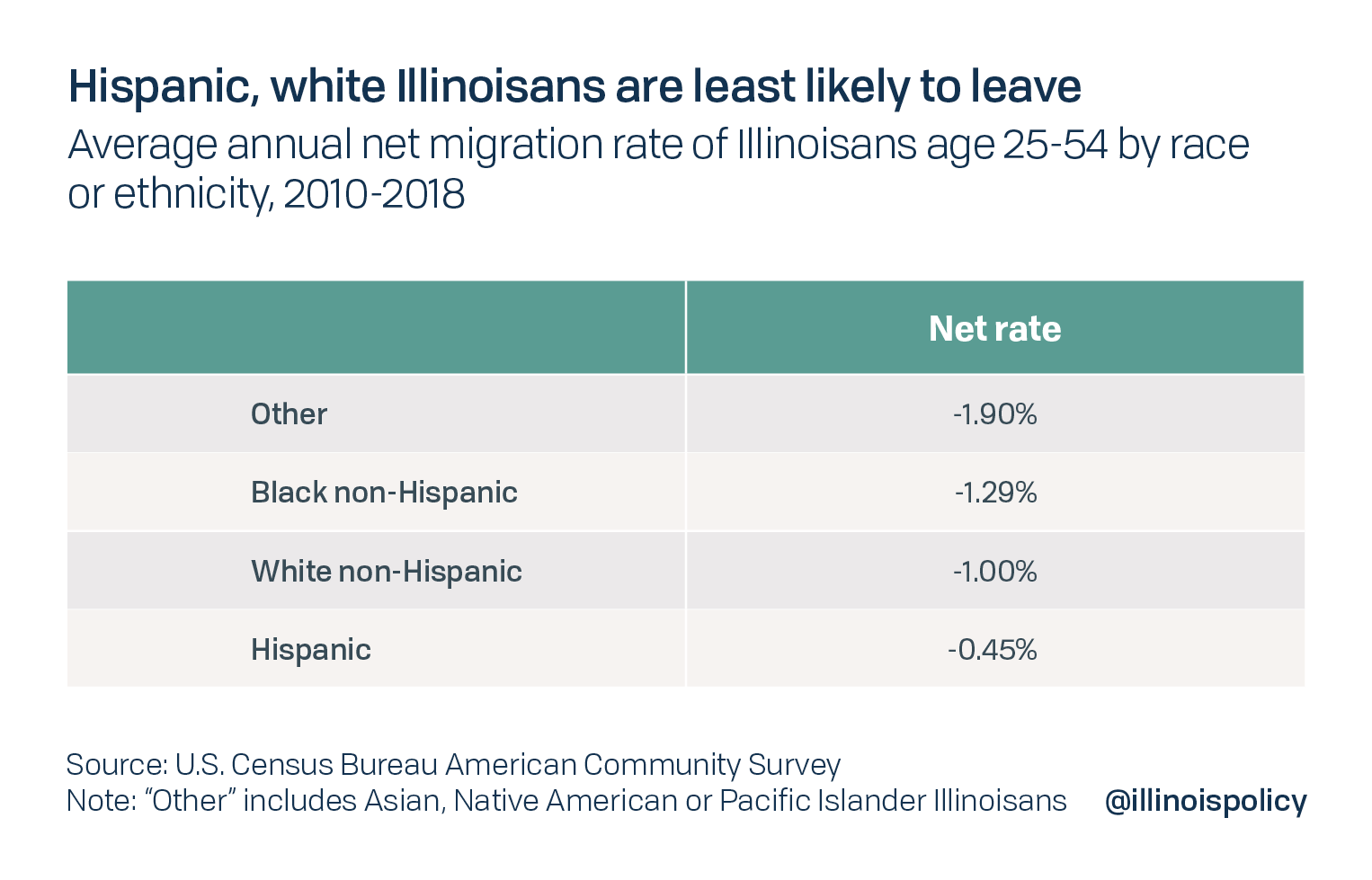

The Illinoisans who are most likely to leave the state on net are Asian, Native American and Pacific Islander, and Black Illinoisans. Meanwhile, white and Hispanic Illinoisans are less likely to leave the state on net.

The out-migration of the state’s Black population has actually led to a decline in the total number of Black Illinoisans.

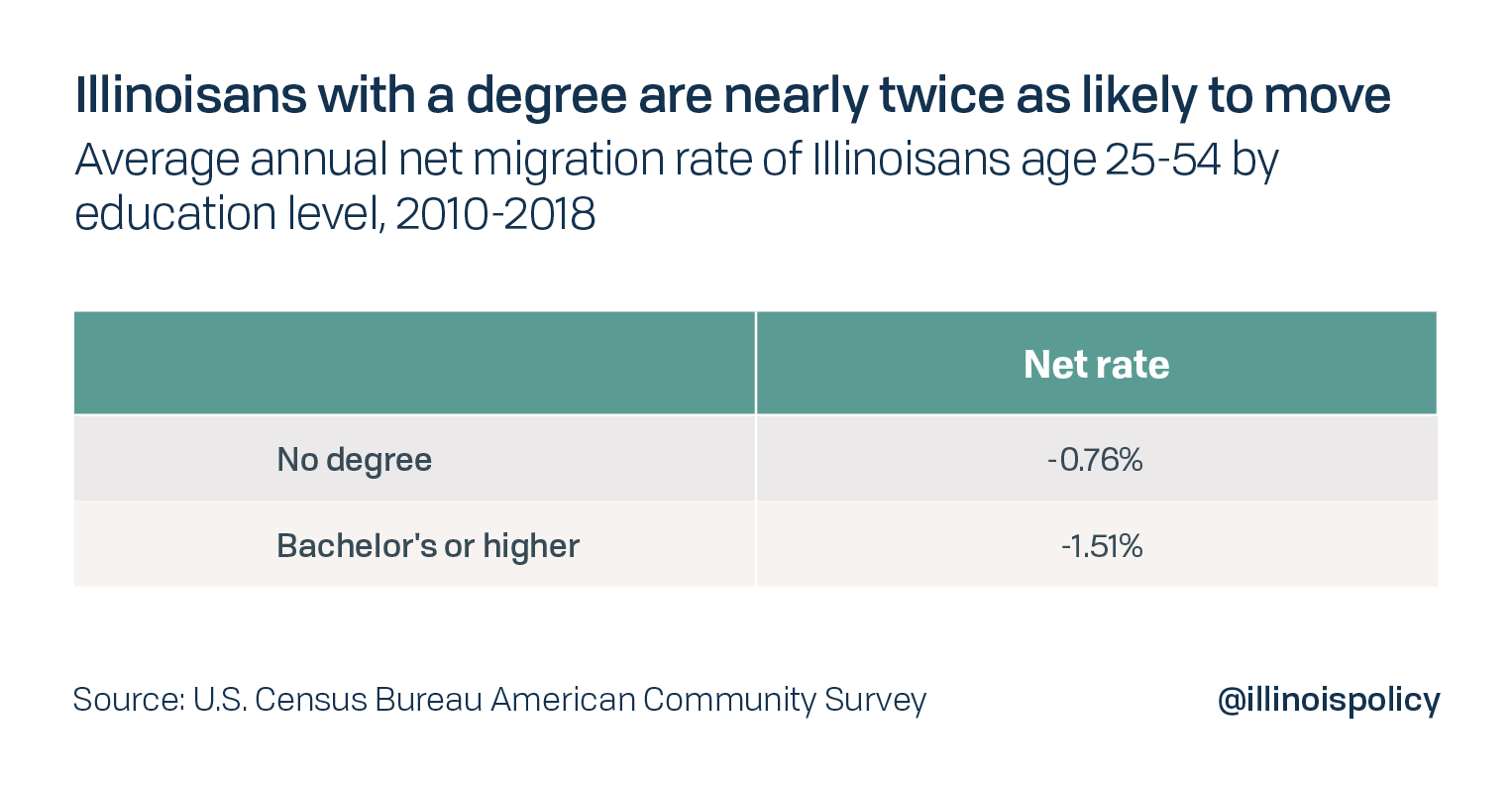

The likelihood that an individual migrates also depends on that individual’s education attainment. Similar to the racial breakdown of who the state loses, Illinois loses more residents without college degrees, but only because they are more prevalent in the population.

Meanwhile, individuals who have attained higher levels of education are nearly twice as likely to leave the state on net.

This is likely because education raises the rate of job offers and the wages of workers. As a result, the expected net gain from moving is higher for those individuals who are more likely to receive job offers in other states. In other words, more highly educated individuals move at higher rates because they more often have the means and opportunities to do so.

While Illinoisans who have not completed a college degree make up the largest share – 51.9% – of prime working-age outmigrants, this is simply because college educated Illinoisans still make up a smaller share – 36.3% – of the Illinois prime working-age population. College educated workers are almost twice as likely to leave Illinois as those without a college degree.

Improving the health of the state’s labor and housing markets has the ability to improve outcomes for all Illinoisans and allow the state to begin attracting more highly skilled residents from other states.

Where are they going?

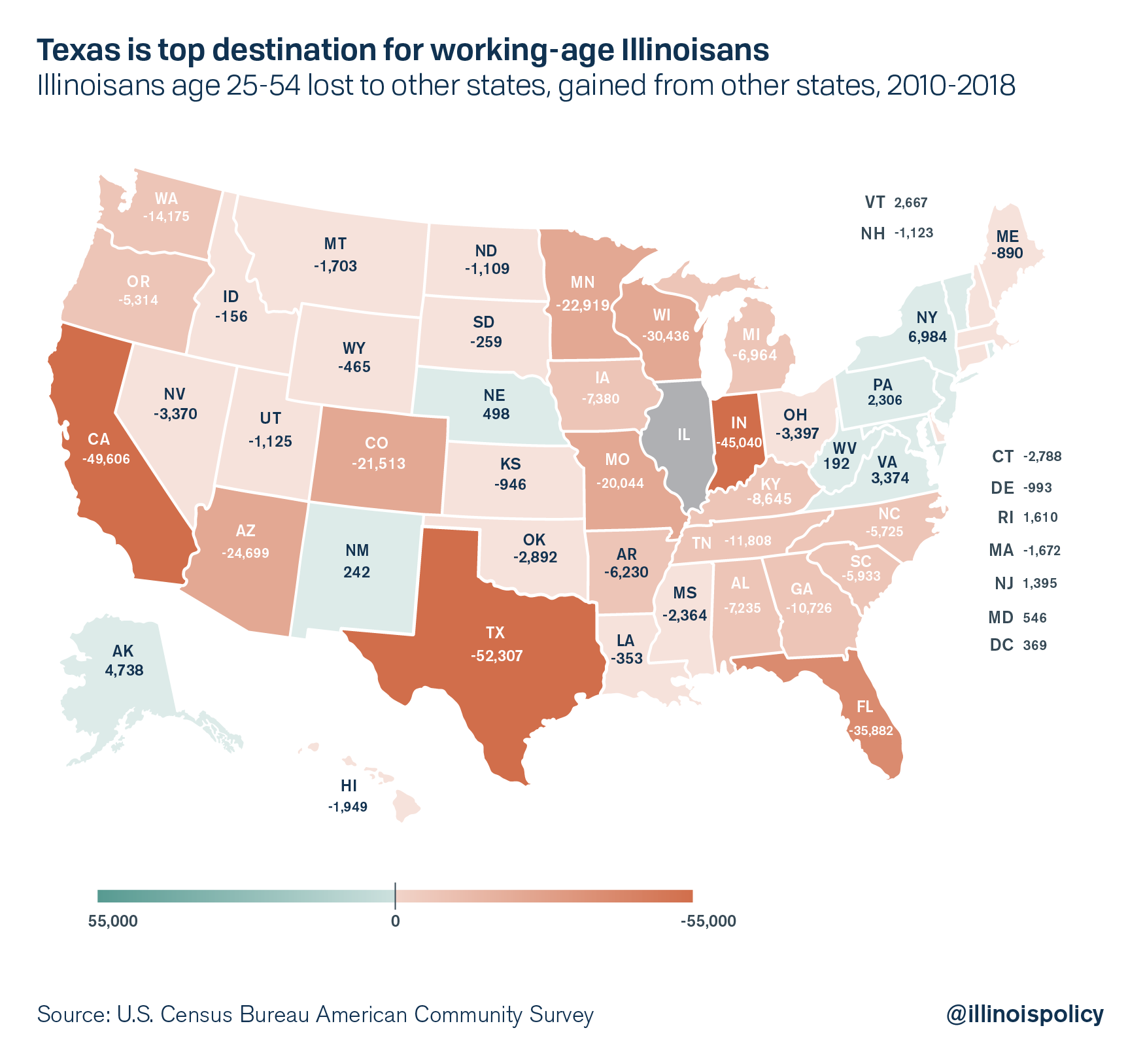

Illinois has been losing prime working-age residents on net to nearly every state. The top destinations for Illinoisans are Texas, California, Indiana, Florida and Wisconsin.

However, with the exception of Texas, which attracts Illinoisans of all stripes in large numbers, where Illinoisans go by demographic can vary widely, with different groups of Illinoisans going to different states. For example, while white Illinoisans are most likely to go to Wisconsin, California and Florida, Black Illinoisans are most likely to go to Indiana and Texas, with California a distant third. Meanwhile, Illinois actually gains Hispanic residents from California.

There are also wide differences among education levels. For example, Illinois loses the most college-educated residents to California, Texas, Colorado and Indiana; meanwhile, those without degrees go to Indiana, Texas, Florida and Wisconsin.

To build a more inclusive, less unequal economy, Illinois lawmakers should look to the places where minorities and less skilled Illinois workers are fleeing for policy proposals. For example, when looking at states where Illinoisans of all demographic groups migrate: Texas and Florida have no income tax, Indiana has a low flat tax and low property taxes, and Wisconsin has fully funded pensions, a generous standard deduction for low income taxpayers and generous tax credits.

How taxes affect labor and housing markets

Tax hikes harm the economy by decreasing disposable income and by discouraging businesses from investing and hiring more. Falling demand for goods and services reduces the expected profit to a business from creating additional jobs, resulting in fewer job openings for workers. Higher taxes also mean that households save and invest less, resulting in permanently lower before-tax incomes.

Individual income taxes also affect employment through the supply of workers. A policy that raises after-tax wages could reduce the net outflow of workers to other states and encourage more workers to look for work in Illinois.

Reversing the Illinois exodus would also require the pace of new openings – labor demand – to exceed increases in the number of job seekers. Comparing contiguous border counties across the nation from 1970 to 2010, economic researchshows increases in corporate income tax rates lead to significant reductions in employment and income. This is because income taxes exert a statistically and quantitatively significant influence on investment decisions.

Economic research also reveals strong housing demand is often linked to robust employment growth. Researchers found a strong negative correlation between an area’s housing prices and the area’s unemployment rate. The authors found after a negative economic shock – the last recession, for example – areas where housing prices declined the most also experienced the highest decline in employment.

In Illinois, a weak housing market before COVID-19 was already linked to weak employment growth. A further decline in housing price appreciation will likely result in less wealth accumulation for homeowners, and therefore reduced economic activity that further reduces the pace of job creation and slows economic growth.

All the evidence suggests taxes are an important reason for Illinois’ exodus because they reduce the availability of desirable job and housing options.

Reversing the exodus

Fewer people are looking to plant roots in Illinois because of tax hikes that have reduced investment flows, causing the weak growth in the number of new job openings relative to other states. While the rest of the nation has experienced robust employment growth in the past decade, with payrolls far exceeding their 2007 levels, Illinois has struggled to add jobs at the same pace.

Employment growth in Illinois is lagging the rest of the nation and would get worse if Illinois politicians resort to more income and property tax increases.

Unfortunately, many Illinois politicians, including the governor, want to replace the state’s constitutionally protected flat income tax with a progressive income tax that would hike taxes for the third time in 10 years, and hit over 100,000 small businesses with up to 47% higher taxes just as they try to recover from the COVID-19 recession. Adopting the proposed progressive income tax would prolong the state’s labor market troubles, likely costing the state thousands of jobs and raising housing costs for all Illinoisans. Fewer jobs and higher costs will encourage even more Illinoisans to leave.

Instead of again asking taxpayers for more, lawmakers need to pursue real reforms that would put the state on firm fiscal footing and give much-needed certainty and tax relief to families and businesses.

First, Illinois must address its pension problem, which continues to grow despite record income tax hikes within the past decade. Though pensions take up more than 25% of Illinois’ general fund expenditures, the state pension funds’ debt is growing. But by amending the Illinois Constitution to allow for adjustment of the growth rate of not-yet-accrued benefits, the state can reduce pension debt and ensure the plans can support retirees without overwhelming taxpayers. Such changes could include increasing the retirement age for younger workers, tying annual benefit increases to the actual cost of living and making retirement plans more closely resemble 401(k)s for new workers.

Second, a spending cap could help the state meet Illinois’ constitutional balanced budget requirement, which has been ignored for 20 consecutive budget years. One interesting proposal would be a smart spending cap that ties government spending growth to a measure of what Illinois’ taxpayers can afford, such as growth in state gross domestic product or personal income. Texas and Tennessee have implemented something similar to this, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Responsible government spending growth that taxpayers can afford would provide more stability for families and businesses. But if the state substitutes tax hikes for necessary reforms, Illinois can expect to continue to see residents fleeing to other states.